Governor Abbott Increases Precautions as COVID-19 Numbers Rise

This week, Governor Greg Abbott has taken several measures to increase protection of Texans from COVID-19. Today, the Governor announced a statewide facemask mandate. Governor Abbott’s executive order requires all Texans to wear a face covering over the nose and mouth in public spaces in counties with 20 or more positive COVID-19 cases. Governor Abbott also issued a proclamation giving mayors and county judges the ability to impose restrictions on some outdoor gatherings of over 10 people, and making it mandatory that, with certain exceptions, people cannot be in groups larger than 10 and must maintain six feet of social distancing from others.

“Wearing a face covering in public is proven to be one of the most effective ways we have to slow the spread of COVID-19,” said Governor Abbott. “We have the ability to keep businesses open and move our economy forward so that Texans can continue to earn a paycheck, but it requires each of us to do our part to protect one another—and that means wearing a face covering in public spaces. Likewise, large gatherings are a clear contributor to the rise in COVID-19 cases. Restricting the size of groups gatherings will strengthen Texas’ ability to corral this virus and keep Texans safe. We all have a responsibility to slow the spread of COVID-19 and keep our communities safe. If Texans commit to wearing face coverings in public spaces and follow the best health and safety practices, we can both slow the spread of COVID-19 and keep Texas open for business. I urge all Texans to wear a face covering in public, not just for their own health, but for the health of their families, friends, and for all our fellow Texans.”

On June 30, Governor Abbott issued a proclamation expanding the list of counties that must suspend elective surgeries. Hospitals in Cameron, Hidalgo, Nueces, and Webb Counties must postpone surgeries and procedures that are not immediately medically necessary to help ensure hospital bed availability for COVID-19 patients. The proclamation amends his previous executive order that suspended elective surgeries in Bexar, Dallas, Harris and Travis Counties.

On June 29, the Governor announced that the Texas Health and Human Services Commission (HHSC) is extending the application deadline for the federal Pandemic-Electronic Benefit Transfer program (P-EBT) to July 31. P-EBT is a one-time benefit of $285 per eligible child and can be used in the same way as Supplemental Nutrition Assistance Program (SNAP) food benefits to pay for groceries. Eligible families include those with children who lost access to free or reduced-price school meals through the National School Lunch Program (NSLP) due to school closures.

HHSC partnered with the Texas Department of Agriculture and the Texas Education Agency to launch the $1 billion federal program on June 1 in response to the COVID-19 pandemic. To date, nearly $700 million in P-EBT has been issued to families, benefiting more than 2.5 million children.

State Tax Numbers for June

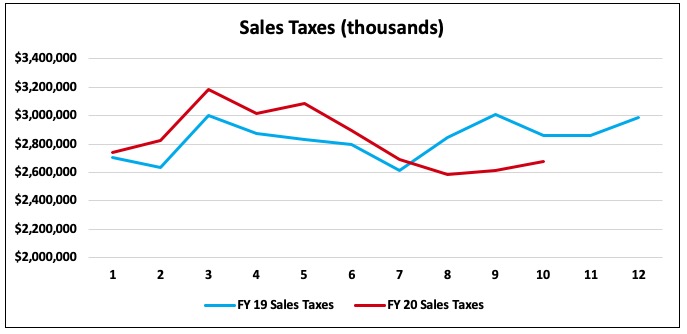

This week, Comptroller Glenn Hegar announced state sales tax revenue totaled $2.67 billion in June, 6.5 percent less than in June 2019. The majority of June sales tax revenue is based on sales made in May and remitted to the agency in June.

According to Comptroller Hegar, “the decline in state sales tax collections was driven principally by steep drops in remittances from oil- and gas-related sectors.” Additionally, “collections from the construction and amusement service sectors were also sharply down.”

Total sales tax revenue for the three months ending in June 2020 was down 9.7 percent compared to the same period a year ago. Sales tax is the largest source of state funding for the state budget, accounting for 57 percent of all tax collections, but the effects of the economic slowdown and low oil prices also were evident in other sources of revenue in June 2020.

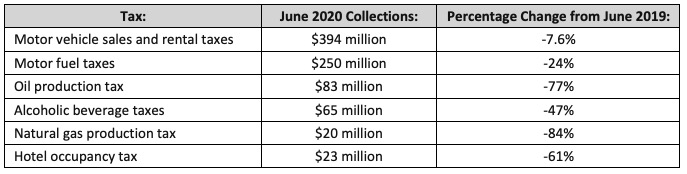

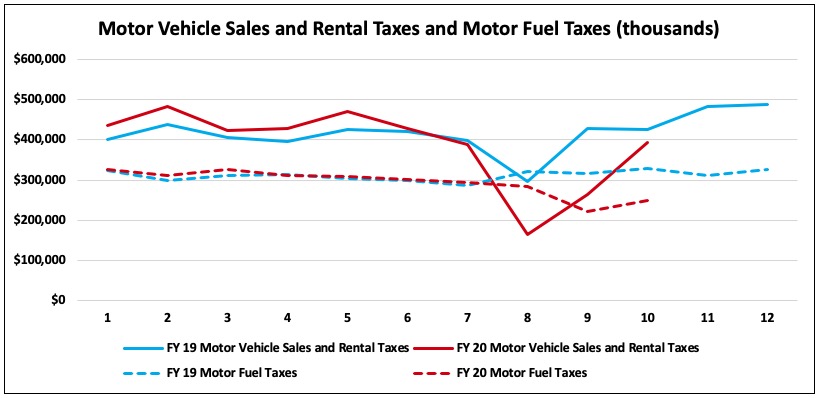

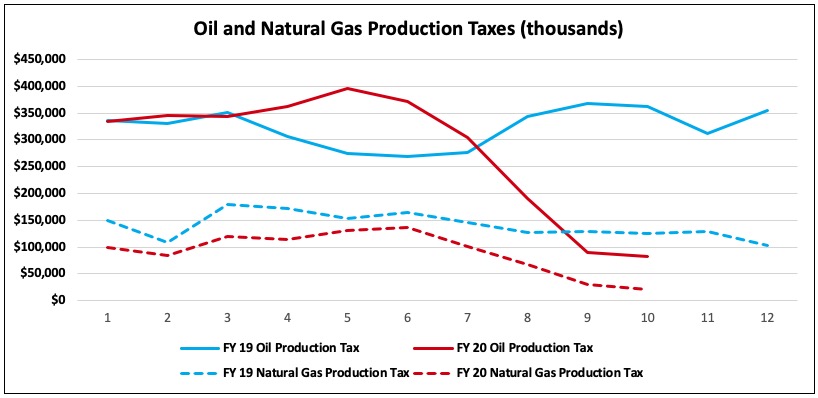

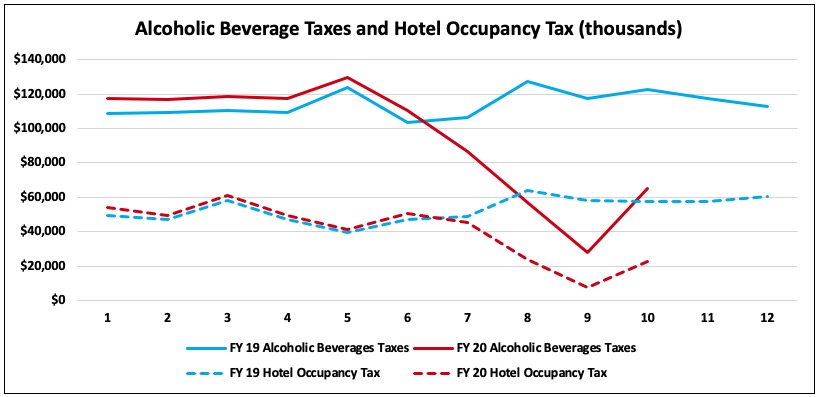

Texas collected the following revenue from other major taxes in June:

The following three graphs compare the monthly collections of six major Texas taxes from fiscal year 2019 with collections for fiscal year 2020.