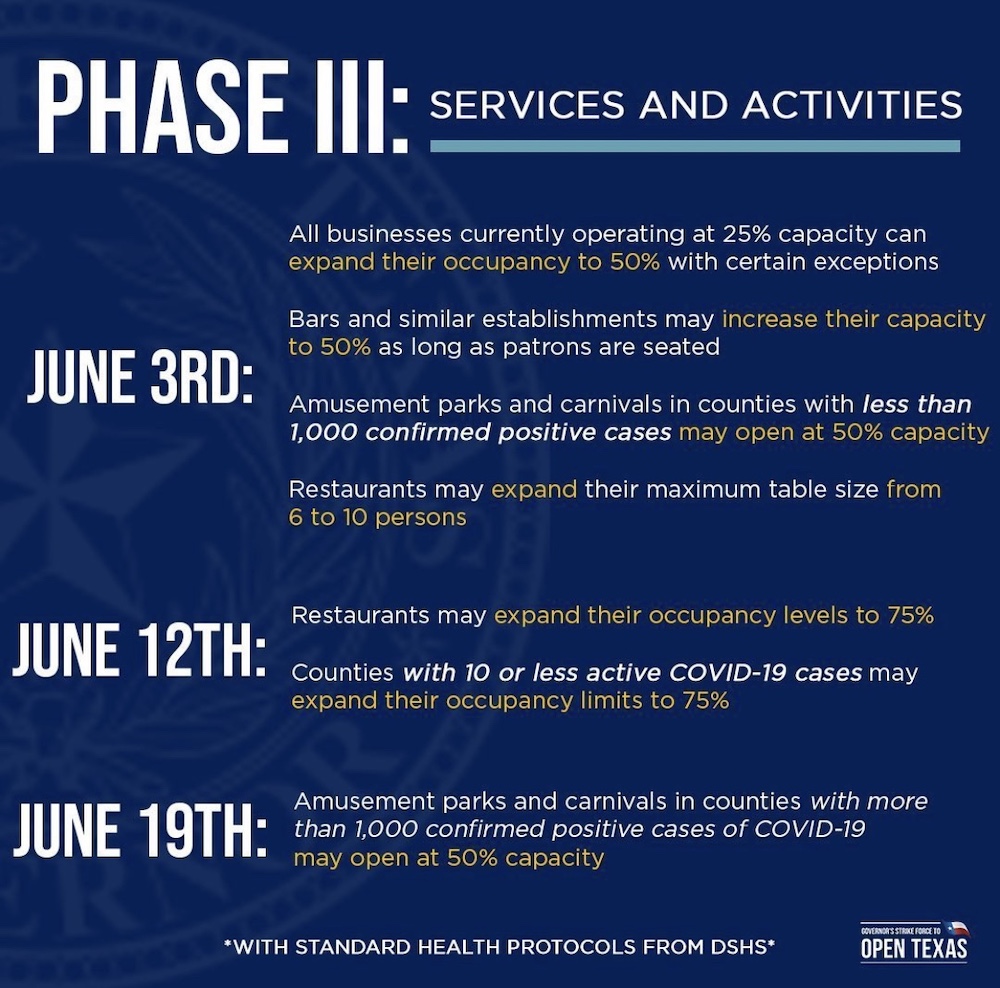

Governor Announces Third Phase of Reopening. On June 3, Governor Greg Abbott announced an executive order implementing the third phase of the plan to reopen the state during the coronavirus pandemic, allowing most businesses to operate at 50% capacity effective immediately. Meeting and event venues may operate at 50% capacity indoors and without a capacity limit outdoors (but must maintain social distancing). “The people of Texas continue to prove that we can safely and responsibly open our state for business while containing COVID-19 and keeping our state safe,” Abbott said in a statement.

Certain businesses, like cosmetology salons and barbershops, massage establishments, personal care and beauty services do not have to comply with the 50% occupancy limit as long as social distancing practices are maintained. On June 12, businesses may operate at 75% capacity in counties with few cases of coronavirus and restaurants may operate at 75% capacity in all counties. The order also ends occupancy limits for religious services, local government operations, childcare services, youth camps, and recreational sports programs.

The full executive order can be viewed here.

State Sales Tax Revenue Figures Released for May. On June 1, Texas Comptroller Glenn Hegar said state sales tax revenue totaled $2.61 billion in May, 13.2 percent less than in May 2019 and the steepest yearly decline since 2010. “Significant declines in sales tax receipts were evident in all major economic sectors, with the exception of telecommunications services,” Hegar said. “The steepest decline was in collections from oil and gas mining, as energy companies cut well drilling and completion spending following the crash in oil prices.”

Texas collected the following revenue from other major taxes:

- motor vehicle sales and rental taxes — $265 million, down 38 percent from May 2019 and a modest improvement over April’s results;

- motor fuel taxes — $221 million, down 30 percent from May 2019 and the steepest drop since 1989;

- natural gas production tax — $31 million, down 76 percent from May 2019;

- oil production tax — $90 million, the lowest monthly amount since July 2010, down 75 percent from May 2019 and the steepest drop since a 77 percent drop in March 1988;

- hotel occupancy tax — $8 million, down 86 percent from May 2019 and the steepest drop on record in data going back to 1982; and

- alcoholic beverage taxes — $28 million, down 76 percent from May 2019 and the steepest drop on record in data going back to 1980.

For details on all monthly collections, visit the Comptroller’s Monthly State Revenue Watch.

Texas Joins Request for COVID-19 Liability Protections. Last week, Texas Attorney General Ken Paxton signed onto a letter to Congress urging federal action to limit business liability for lawsuits related to COVID-19. The proposed legislation would allow lawsuits to proceed against businesses that act in a grossly negligent manner, but would provide liability protection for businesses that take reasonable precautions to prevent COVID-19 spread.

“As we reopen our economies, the need for a stable, predictable legal environment has never been greater. The COVID-19 pandemic is likely to create a surge in civil litigation targeting well-intentioned businesses for taking pandemic mitigation measures; therefore, this country is in need of a common-sense framework to provide liability protections for much-needed goods and services while still ensuring victims are able to seek legal redress and compensation where appropriate,” according to the letter.

The full letter can be viewed here.